GREEN FINANCE AND ITS RELEVANCE TO INDIAN CITIES

Amanpreet Kaur

Amanpreet Kaur

August 4, 2021

August 4, 2021

What is Green Finance?

In simple words, green finance is any organised financial activity or service that’s been created to ensure a better environmental outcome. It generally includes public or private investment and loans that are used to encourage change in favour of environment-friendly and sustainable actions. The focus of this can be on greening of existing infrastructure investments or mobilizing additional investments (both public & private) in key sectors such as renewable energy, sustainable transport (E-Vehicles), retrofitting buildings as green buildings, natural resource management, waste management, sustainable tourism etc.

Why is green finance important for cities?

By 2030, cities are expected to be responsible for 60 to 80% of GHG emissions (UNEP Report,). More than 45% of the Indian population will live in cities. Consequently, the gamut of challenges posed by climate change, rapid urbanisation and infrastructure transformation in the city will be huge.

Cities are essential actors for encouraging green infrastructure such as buildings, transport, water and waste; and municipal finance is one of the promising ways in which this can be achieved. Their main revenue sources, such as property taxes, user fees and other charges such as fuel cess, congestion charges, solid waste manageament cess etc. are based on these same sectors; thus, cities have great potential to ‘green’ their financial streams and avenues.

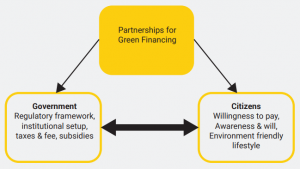

How to promote green financing in cities?

Green finance for cities could be promoted through changes in national or state regulatory frameworks, balancing public financial incentives, increase in green financing from different sectors, alignment of public sector financing decision-making with the environmental vertical of the Sustainable Development Goals, embarking a separate budget as “climate/green budget” in ULBs, increases in investment in renewables energy and green technologies, increase use of green bonds, carbon credits and so on.

The crucial areas for the current work on green financing are:

- Supporting urban local bodies to create an enabling environment for green urban projects and green finance

- Capacity building of government officials to have better visibility of green projects and develop an ecosystem for accessing climate or green finance

- Promoting public-private partnerships on financing mechanisms such as green bonds

Way Forward

The role of ULBs shall be strengthened by continued awareness and capacity building must be included, to identify climate risks and implement green solutions to make cities safe, resilient and green in nature

Subscribe To Our Newsletter

Sign up for our newsletter to stay up to date with the latest in active citizenship and urban governance reforms in India’s cities and towns.